Running a bed and breakfast or serviced apartment can be a pretty lucrative venture when managed well. There are many aspects and functions of this business to pay attention to regularly, like sales, marketing and finances, along with the routine, day-to-day tasks like cooking, cleaning, restocking, payment processing and invoicing.

When it comes to taking payments online or at your on-site point-of-sale, it’s key to have a trusted credit card processor, like ChargeStripe. This just makes the payment process as smooth as it can be for both you and your guests. Here, we’ll go over:

- What bed and breakfasts and serviced apartments are and what the US sector looks like.

- 5 top tools to more easily run a B&B or serviced apartment, so you can enjoy less stress and more free time.

- Some key bed and breakfast or serviced apartment management tasks to pay attention to.

TRY CHARGESTRIPE NOW

Runnning a Bed and Breakfast or Serviced Apartment – The Basics

Bed and breakfasts (B&Bs or BnBs) are typically private family homes with an average of 6 rooms. The hosts usually live on the premises or in the home and provide a daily breakfast for their guests. On the other hand, serviced apartments have all the typical amenities of a private apartment, such as furniture, kitchen appliances, and bedding. They include some hotel conveniences like housekeeping, but come with extra space and privacy and usually for a cheaper price.

Both bed and breakfasts and serviced apartments provide short and long-term accommodations to various types of guests, including singles, couples and families taking leisure trips, business travelers, and students. In 2021, the US sector was worth approximately $2 billion and created over 20,000 jobs.

5 Handy Tools for Running a Bed and Breakfast or Serviced Apartment

ChargeStripe

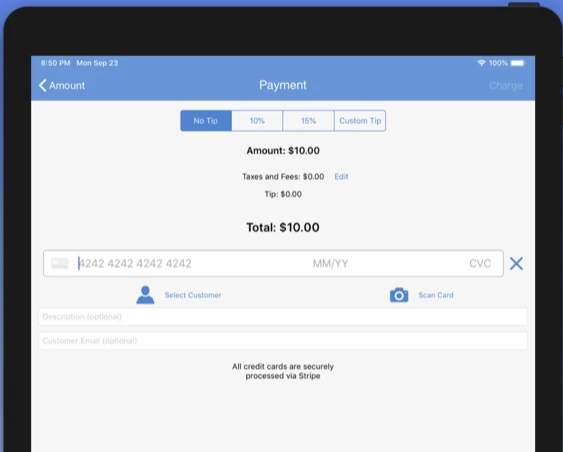

ChargeStripe is a Stripe card reader that allows you to connect your Stripe account so you can accept credit card payments from your mobile device.

Available on both iOS and Android, the tool is backed by helpful and knowledgeable customer support, manages payments in 27 currencies and 46 countries, and takes less than 5 minutes to set up. Here’s how.

How to Get Started with ChargeStripe

To get going with ChargeStripe, follow these steps:

1. Download the ChargeStripe app, which is free from the Android app or Apple store.

2. Set up your Stripe account within ChargeStripe’s app, or enter your information to connect your existing account. If you’re initially setting up your Stripe account here, set aside about 30 minutes and have the following ready:

- Business email address, which will be your login and where Stripe sends payment notifications.

- Physical business address, which can be in one of the 46 countries currently supported by Stripe, including the US and Canada.

- Business phone number, which will be entered as your “customer support” number.

- Social Security Number (SSN) for sole proprietors, or Employer Identification Number (EIN) for LLCs or S-Corps.

- Website or social media profile, which Stripe uses as part of its verification process.

- Personal information including your name, home address, and birthday.

- Banking information, including a checking account routing number and bank account number so you can receive payment transfers through Stripe.

This may seem like a lot, but don’t be overwhelmed. The application process helps to ensure people aren’t using Stripe for fraudulent activities, which helps you since maintaining security and high customer trust means your integrity won’t be questioned when it comes to handling your customers’ credit cards and other personal information.

3. Accept credit card payments and send invoices from anywhere, anytime. Once approved, you can start accepting credit card payments right away. When your guests arrive at or check out of your property, you can swipe their card in-person with your phone’s camera or a card reader. It’s also easy to take payments on the phone by typing in credit card details right on your keypad or sending a confirmation and payment request via text or email.

Keep in mind that Stripe can take a few business days to approve your account or flag issues that might arise. So, since your initial payment will take some time (about 7-10 days) for processing, it’s wise to pay yourself a small amount right away to get that step done. Then, you should see payments within about 2-3 days.

TRY CHARGESTRIPE NOW

You can also check out this handy video on using ChargeStripe:

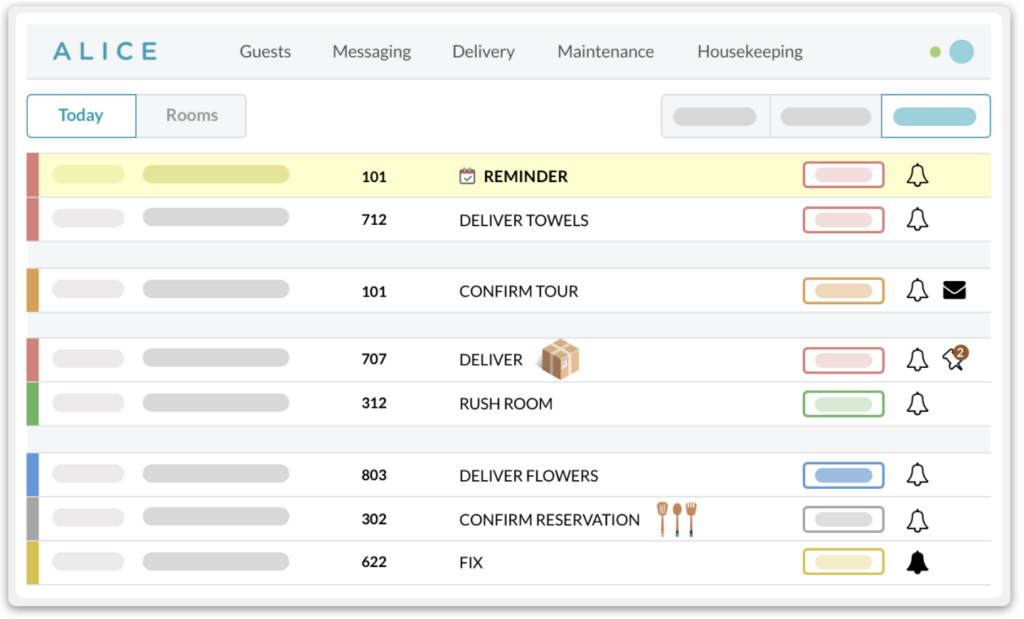

ALICE Suite

The all-in-one ALICE Suite streamlines your B&B or serviced apartment communication and operations, boosts the productivity of you and your team, and increases your guests’ satisfaction. The tool connects all aspects of your business so there’s clear, streamlined, cross-departmental communication at all times. With the tool, you can:

- Make informed, data-driven decisions with a quick yet complete understanding of your property.

- Use cloud-based mobile technology to track and monitor real-time guest and staff requests.

- Arm your team with all they need to provide excellent customer service.

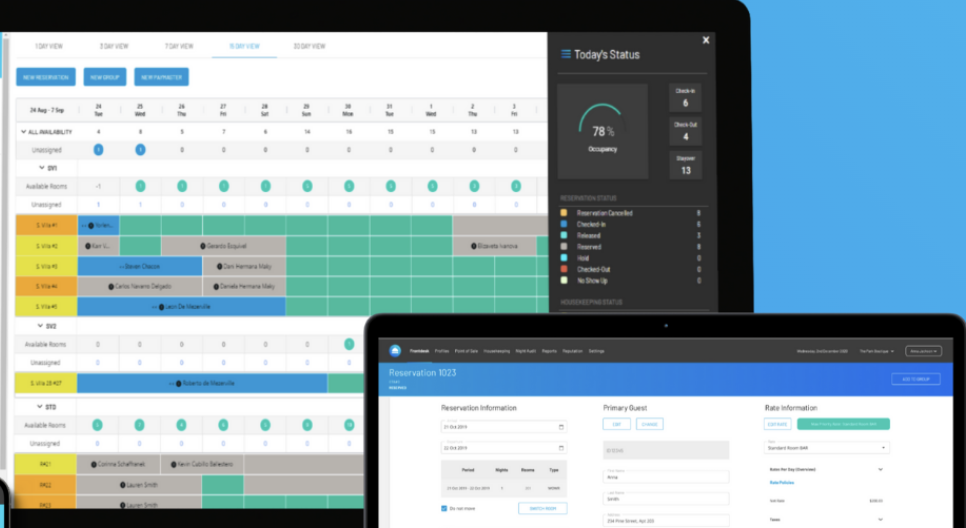

Frontdesk Anywhere

The Frontdesk Anywhere tool comes with a wide range of functionality. For one, it’s a complete property management system that improves your daily front desk operations. It comes with a channel manager that connects your business to major online travel agencies, so you can optimize your occupancy. As well, the tool comes with a commission-free, mobile-friendly internet booking engine and a custom website solution so you can make your brand known. There are even channel recommendations and smart pricing tools to manage your revenue better.

Marketing Tools to Inspire Content Ideas

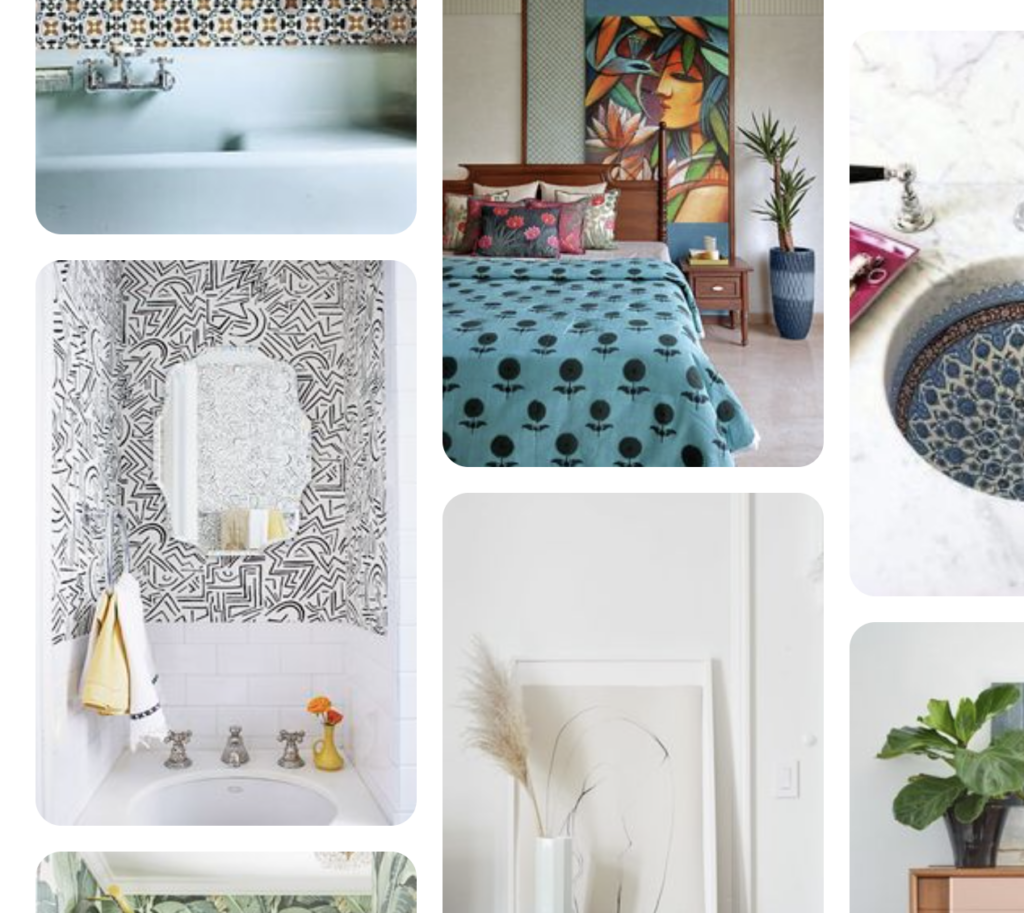

In hospitality, as in many businesses, engaging, relevant content is one key to getting more exposure and, eventually, sales. This can be easier said than done since sometimes we all need a bit of inspiration. You may not have thought of these more general tools used by many industries and consumers alike, not just B&Bs and serviced apartments. Don’t overlook them, as they can inspire creativity and new ideas when it comes time to execute on your content marketing strategy.

Pinterest doesn’t need to be just another social media platform but instead try seeing it as a valuable resource for BnB or serviced apartment content marketing inspiration and ideas. Simply type “[your locale] + ideas” into Pinterest, see what pops up, and let the juices flow. You’ll also find other suggested search terms with your results if you’re looking for more ideas.

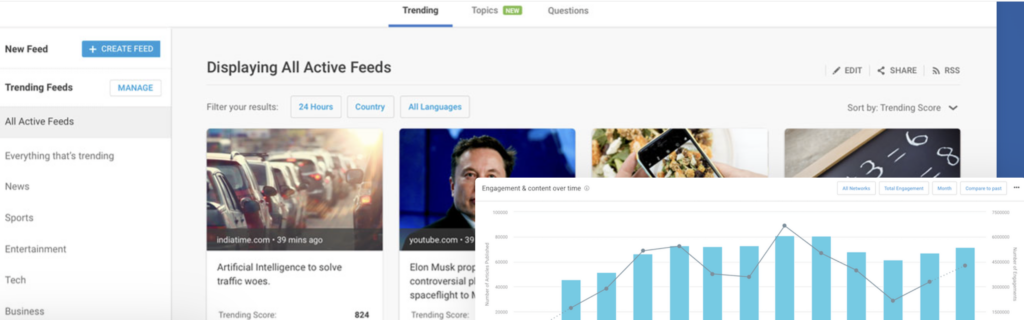

Buzzsumo

To get a sense of the trending topics around your property’s location, check out Buzzsumo. It’s very easy to use, by just entering your location or another phrase or keyword and searching. From there, you’ll see popular related content, listed by social shares. The tool also lets you search by domain, so you can input your competitor’s site to see what’s been shared the most and where they’re succeeding.

As well, you can filter results by Buzzsumo’s “Evergreen Score” feature to see relevant, non-time-sensitive content no matter the time of year. It’s wise to create high evergreen-scored content that expands and adds value to what already exists.

TRY CHARGESTRIPE NOW

With these key tools for managing B&Bs and serviced apartments in mind, take a look at these key tasks for your business. As you read through, think about the processes you have in place and what can be improved with the help of tools like ChargeStripe and others.

What Do I Need to Do? Key Tasks for B&B or Serviced Apartment Owners

It takes a lot of work to successfully manage a bed and breakfast or serviced apartment. There are many standard things to consider, like cleaning, restocking rooms with linens, toiletries, dishes and other supplies, and, in the case of B&Bs, what you’re serving for breakfast and when.

Branding, Marketing and Sales

As you know, without a regular stream of guests, you won’t have a viable B&B or serviced apartment business. To get those guests finding you and coming to your property, you’ll need to decide how you want your brand to look, which ties into your sales and marketing strategy. This means figuring out who you’re targeting and what they’re looking for, so you attract those who are interested in what you offer and want to stay there. For example, if you run a serviced apartment, maybe you’re targeting business travelers who visit for up to a week. Or, you might have a B&B on a lake perfect for swimming and other family vacation activities.

When you’ve figured out your target market and niche, your next step is creating and maintaining your marketing strategy to align with it. To do this, consider the following tasks:

- Create a website that clearly identifies who you are, what you’re offering and for what price, along with how to book a stay and get in touch with you.

- Get as much information and exposure as possible through your local tourism association and chamber of commerce, and by attending local events or trade shows.

- List your accommodation on B&B websites, VRBO, Airbnb and any others your local market might use.

- Reach out to service providers you’ll need (such as cleaners or wholesale food suppliers) and set up contracts and service arrangements.

- Post blog articles to reach your audience online, and learn some SEO basics to rank high on Google searches.

- Create and send out a newsletter regularly, and ask your past and potential guests to sign up for it.

- Offer the best possible service you can to your guests, so they’re encouraged to recommend you to others through word of mouth.

- List your property on TripAdvisor and ensure you’re responsive to reviews and keeping it up-to-date.

Managing Finances and Room Rates

As in any business in any industry, it’s imperative to manage your finances well. For one, this means setting your BnB or serviced apartment room rate accordingly, as best makes sense for your business. Typically, to get this you’ll want to divide your total expenses by your number of expected bookings over a period of time. Doing this will give you a profit margin per visitor and a basis for calculating your room rate.

Your room rate will depend on various factors, such as the services and amenities you offer, your location, the average rates in your area, and the season and day of the week per booking. Your expenses will often include:

- Mortgage payments (unless you own your property outright).

- Design and decor, including paint, pictures or wall hangings, linens, trinkets, and other decorative items.

- Operating costs like food, utilities, cleaning, insurance, salaries for yourself and other team members, and others.

- Annual expenses such as property and other taxes and professional fees for accounting.

Managing Payments

You’re providing a service to your guests, and, of course, you’ll be compensated for that service. Therefore, you need to ensure your payment management practices are secure, smooth and straightforward. Here are just a few things you’ll need to consider around this.

As a business owner, you’ll need to decide on the types of payment methods you’ll accept. Cash and debit cards are typical for B&Bs and serviced apartments, but don’t rule out credit cards as well. There are a variety of benefits to be had for both you and your guests when you choose to accept credit cards.

Benefits of accepting credit cards for your guests

As a consumer, you probably feel the benefits of paying by credit card for many things in daily life. This is no different when it comes to your guests. Credit cards are:

- A safe and trusted way to pay, online or in-person.

- Fast and convenient to use.

- The most preferred way to pay compared to other methods.

- Helpful to track spending.

- Included with the extra perk of points or rewards programs.

Benefits of accepting credit cards for B&B and serviced apartment owners

As the owner of a BnB or serviced apartment, you’ll enjoy many things by accepting credit card payments from your guests. For one, you have the chance to boost nightly bookings, since you’re exposed to a wider base of credit card users, worldwide. Remember, people often can’t or don’t wish to pay via other methods, plus this allows them to prepay or provide a security deposit to hold a room in advance. Then, once your guests are on-site, they aren’t limited by a finite amount of cash and can conveniently choose to pay for more services you might offer, such as extra meals, room service or tours. This is a win-win, as they get an enhanced experience and you get more sales and profit. You can conveniently and easily process payments with ChargeStripe using your phone, or via credit card machine if you have one.

Finally, by accepting credit cards, your bed and breakfast or serviced apartment business will have a competitive advantage over others since this is a convenient and common payment option that guests have come to expect. It can also elevate you to a bigger competitive playing field if you’re a smaller operation since you’ll remove payment method option as a reason – and barrier to you – for someone to look elsewhere.

Two points of contact = two payment opportunities

Your business works within a model where people can reserve and pre-book what you offer ahead of time before arriving at your B&B or serviced apartment. This means you have two points of contact and two opportunities to collect payment. So, whether you’re requiring prepayment or providing the option for it, you need a way to manage both online payments in advance or on guest arrival, and offline, on-demand payments. (By the way, the option to prepay is often done in exchange for a small discount, as incentive to the guest, and is a great strategy to utilize if one of your business goals is to improve cash flow).

Either way, ChargeStripe can help you manage offline in-person payments through the app or approved card reader. The tool seamlessly integrates and processes payments with Stripe by connecting your mobile device to accept credit card payments, manage guest information, and send invoices or receipts.

Plus, if you’re renting out a luxury serviced apartment, an entire bed and breakfast property, or some other high-priced accommodation, ChargeStripe can easily and securely manage those payments. It does so in a way that lets you track payments and get paid out quickly directly from the app, without a monthly fee. In fact, ChargeStripe has transparently clear pricing. You simply pay a 1% fee plus Stripe’s processing fees – there are no recurring membership, minimums, or hidden fees whatsoever. Plus, you can pay as you go and only when you use the app.

Invoicing and Issuing Receipts

The more time you can save when it comes to invoicing or sending receipts to your customers and guests, the more time you’ll have to focus on other important aspects of your hospitality business.

When you’re able to accept online and mobile payments, for both iOS and Android, you can be flexible and ready to meet your guests’ different needs. This means using a tool to quickly and easily send invoices or payment requests online, via email, or SMS, from anywhere, whether you’re at the lobby of your serviced apartment, the dining table of your B&B, or your home office down the street. ChargeStripe makes this easy with options to type in card details manually, securely scan a card with your device’s camera, or directly send a payment request to guests via text message or email.

Setting Up Recurring Payments

Say you have a frequent business traveler who loves the view, open and airy feel, and attentive team that your serviced apartment offers. If they’re making trips to your area, say, every month or quarter, wouldn’t it be nice to offer them a hassle-free instant payment option? This is where recurring payments can come in quite handy.

Good news, you can get tools that come with this feature built-in. When you use ChargeStripe, it takes about 7-10 business days to see that first payout in your bank account (which you can always send to yourself to get the waiting game out of the way). But then it’s much quicker, only taking 2-3 days.

Now that you’ve got a rundown on some important tasks for managing B&Bs or serviced apartments, take a look at the many small business tools available to you that help to make these things as quick and painless as possible.

You should be well equipped and on your way to improving your bed and breakfast or serviced apartment operations. With tools like ChargeStripe and other hospitality solutions out there, your systems and processes will be easy, quick and streamlined, so you and your team can achieve more with less stress.