As a merchant, one of the biggest perks of using Stripe is the ability to start accepting payments immediately after you sign up. All you have to do is fill in basic information about your business and bank account, and your account will be approved.

However, because Stripe doesn’t make merchants go through an initial approval process, it’s not uncommon for business owners to find out that their account has been restricted shortly after signing up and collecting payments. So, what do you do if your Stripe account gets restricted or suspended?

This is one of the most common questions we receive from our customers — and although ChargeStripe has no control over Stripe’s platform and how they handle restrictions and suspensions, we’ve learned enough over the years to help point you in the right direction if you end up receiving one of those daunting emails. To help you recover your account and start collecting payments again, we’ve put together some tips on how to not get your stripe account suspended — and, if it happens, — how to resolve the issue.

Table of Contents

- Why your Stripe account might be suspended or rejected

- How to resolve an account issue if your account is suspended

- Why you need to connect your Stripe account to use ChargeStripe

- Stripe Account Suspended: FAQs

Connect Stripe to ChargeStripe Now

Why your Stripe account might be suspended or rejected

Unfortunately, having your account suspended or restricted by Stripe is not uncommon. And worse, it can be frustrating and confusing for merchants who are unsure which term they have violated.

Account suspensions and restrictions are up to Stripe’s discretion. Suspensions are typically due to Stripe needing more business information, while restrictions are due to suspected fraudulent activity (Stripe is not clear about what it deems fraudulent).

However, Stripe is clear on their policy for restricting what they consider “high-risk businesses.” Stripe’s banned businesses include:

- Businesses that are located in or provide goods/services to Cuba, Iran, North Korea, Crimea Region, and Syria

- Industries with a higher likelihood of chargebacks and fraud include bankruptcy lawyers, door-to-door sales, medical benefit packages, telemarketing, remote technical support, etc.

You can view the complete list of restricted businesses on their website, which also includes illegal products and services that Stripe suspends (adult content, gambling, counterfeit goods, etc).

Stripe might also consider your business high risk if you sell digital products and services with no footprint or paper trail to prove that customers received their purchase or if your business sells its products or services in countries outside your residence. This is because these types of sales are harder to track and tend to receive more customer complaints.

The good news is — if you’re running a legitimate business and have provided Stripe with accurate details and payment information, the chances of your account getting shut down are much less likely. However, ensuring all your bases are covered when you start using the platform is a good idea. Here are a few tips to minimize the risk of Stripe account suspension:

1. Fill out all necessary information when creating your Stripe account. Do not leave anything blank, and make sure all the information is accurate.

2. Update all of the information on your Stripe account as it changes. According to Stripe’s Know Your Customer (KYC) obligations, “We may also reach out periodically to confirm that information on your account is still accurate.”

3. Be aware of multiple failed payments. If you’re experiencing repeated chargebacks and declines, Stripe will review your account to determine if it should be suspended.

4. Use an accurate website listing for your business. We’ve seen people use generic URLs like instagram.com, AAA.com, and website.com as their business’s website URL, which may cause Stripe to flag your account. If your business doesn’t have a website, don’t worry. You can also use a company’s social media profile. If you don’t have either, take a few minutes to set up a Facebook or Instagram business account.

5. Don’t forget to have a customer support phone number. Your business may not have a dedicated support number, but leaving this part blank or filling out a 000-000-0000 isn’t an option. Instead, set up a free Google Voice phone number.

6. Make sure you aren’t on their list of restricted businesses. We mentioned above that Stripe has rules against the usage of its platform by certain industries and locations.

Connect Stripe to ChargeStripe Now

How to resolve an account issue if your account is suspended

Stripe will communicate to merchants (typically through email) to notify them of the rejection, why it was rejected, and what will happen to the funds in the account. Typically, this involves a 90-day holding period before funds are released to ensure there is no fraudulent activity. If you believe your account was rejected incorrectly, Stripe recommends contacting their customer support team to resolve the issue.

Getting your account rejected or suspended is never fun, but if you haven’t violated one of Stripe’s terms and conditions, you have a good chance of getting your account back up and running after appealing it. For more information on how ChargeStripe and Stripe work, check out How to Accept Mobile Credit Card Payments on Stripe.

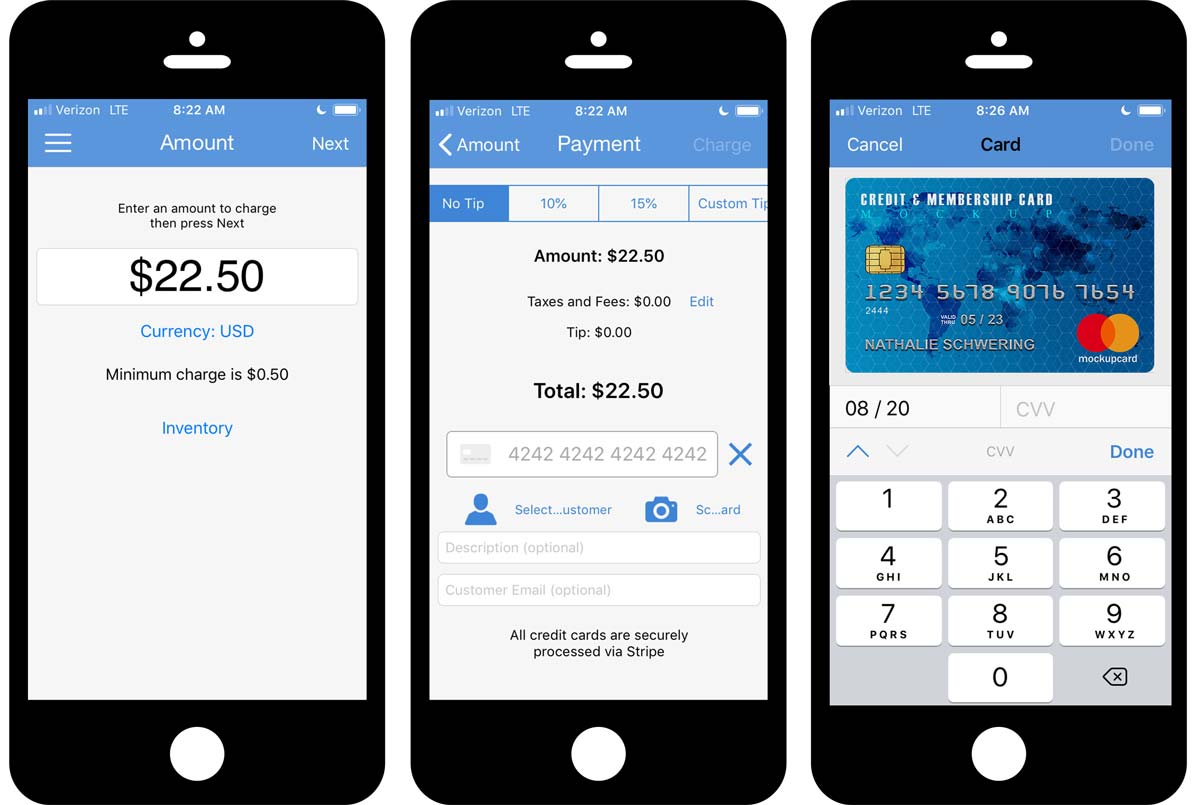

Why you need to connect your Stripe account to use ChargeStripe

ChargeStripe is a partner platform of Stripe that allows you to accept mobile payments from anywhere by scanning credit cards with a phone’s camera, typing in card information, or swiping with a card reader. All you have to do is download the ChargeStripe app and sign in to your Stripe account. Without a Stripe account, users cannot login and use the app, but ChargeStripe makes it easy for first-timers to set up a new Stripe account directly from the app. If you already have a Stripe account, it takes only a couple of minutes to be up and running on ChargeStripe.

The process for connecting a Stripe account:

Simply logging in with your Stripe account credentials connects the Stripe account to the ChargeStripe app. If you do not have a Stripe account when you sign up for ChargeStripe, you will need to set one up. Keep in mind, it takes around 30 minutes to complete Stripe’s signup process. As we’ll discuss in a bit, one of the common reasons why Stripe ends up suspending or rejecting accounts is because account information is incomplete or inaccurate, so make sure to thoroughly and accurately fill out the following details when you sign up for a Stripe account:

- Business email address

- Business street address

- Business phone number

- Customer support phone number

- Social Security Number or Employer Identification Number

- Your business’s website or social media profile

- Full name, street address, and date of birth

- Last four digits of your Social Security Number

- Checking account routing number and bank account number

Stripe Account Suspended: FAQs

Why was my Stripe account suspended or rejected?

Suspensions can occur because Stripe requests more business information (Stripe does not disclose what they consider to be fraudulent). On the other hand, restricted accounts are due to suspected fraudulent activity (Stripe is explicit about what constitutes a high-risk business). Stripe informs its clients which companies are banned due to their high-risk status. These businesses include those in or offering goods and services in Cuba, Iran, North Korea, Crimea, and Syria. (Stripe lists bankruptcy lawyers, door-to-door sales, medical benefit packages, telemarketing, remote technical assistance, etc., as examples of industries with a higher probability of chargebacks and fraud).

How can I connect my Stripe account to use ChargeStripe?

Connecting your Stripe account to ChargeStripe is easy. All you need to do is create a Stripe account. Then, download ChargeStripe on your iOS or Android device. Then, open up ChargeStripe, log in with your Stripe account details and enjoy! It’s that simple.

What does ChargeStripe do if my Stripe account was suspended?

Unfortunately, there isn’t anything ChargeStripe can do about Stripe suspensions. You will need to contact Stripe’s team directly to find out why your account was suspended.

Conclusion

As we have seen, Stripe suspensions can occur for various reasons. If you are unsure about the status of your account, you will need to contact Stripe’s customer support team to resolve the issue. Once your Stripe account is no longer suspended, you can use ChargeStripe to seamlessly accept your payments.